#Robinhood family 20yearold who committed suicide full

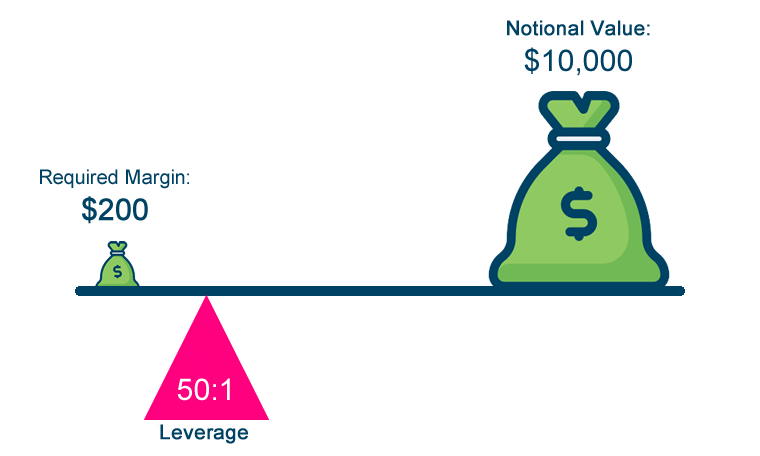

Read the full Forbes report, which includes an explanation on how a "bull put spread" could make for a confusingly large stock position in a portfolio, here. Per the report, his parents discovered a note on his computer in which he asked how a 20-year-old "with no income" was able to "get assigned almost a million dollars worth of leverage." Also in the note, Kearns said he had "no clue" what he was doing on Robinhood.

"This is an interface issue, they have slick interfaces." "Tragically, I don't even think he made that big of a mistake," Brewster, who is a research analyst, told Forbes. Kearns' cousin-in-law Bill Brewster, for example, argued that the interface essentially makes trading into a game. We remain committed to making Robinhood a place to learn and invest responsibly.The app has recently seen a surge in popularity, though Kearns' death is shining a light on the importance (and arguable shortcomings) of the interfaces used by the service and others like it. Family Sues Robinhood After Naperville College Student Died by Suicide Thinking He Owed 730K The family of Alex Kearns accused Robinhood of wrongful death, negligent infliction of. We also changed our protocol to escalate customers who email us for help with exercise and early assignment. "In early December, we also added live voice support for customers with an open options position or recent expiration, and plan to expand to other use cases. "We were devastated by Alex Kearns' death," the spokesperson said. The spokesperson said the improvements included adding the ability to exercise contracts in the app, guiding customers through early assignments, updating buying power displays, offering further education materials, and furthering its financial and experience criteria for options. In a statement to Insider, a Robinhood spokesperson said the company had made improvements to its options offerings since Kearns died. "And possibly completely wrong, because they make it look like you owe $730,000 when you really don't owe anything. "The information they gave him was just incredibly skewed," Benjamin Blakeman, one of the Kearns family attorneys, told CBS News. In their lawsuit, Dan and Dorothy Kearns said Robinhood "must be held accountable" for their son's death. In a note to his parents before he died, a note seen by CBS News, Kearns questioned why he was assigned "almost $1 million worth of leverage," and said he had "no clue" what he was doing.ĭan and Dorothy Kearns told CBS News that if a Robinhood customer-service agent had helped their son with his questions, he might still be alive. Read more: GENERATION ROBINHOOD: How the trading app conditioned its inexperienced users to obsessively play the market Could someone please look into this?"ĬBS News reported that Robinhood responded with an automated message saying the company was "working to get back" to Kearns. On the day Kearns died, his Robinhood account had been restricted and showed a negative $730,000 cash balance.Īccording to the suit, after he realized the debt, Kearns emailed Robinhood and asked for help in understanding the losses, saying: "I was incorrectly assigned more money than I should have, my bought puts should have covered the puts I sold. They told CBS News that their son had been trading on Robinhood since before he graduated from high school, and had been approved to buy and sell complex options trades, which can leave temporary balances and debts while settling over several trading days. While it's unclear why Kearns killed himself, the 20-year-old parent's say in their lawsuit filed on Monday that they believe Robinhood's response to his supposed loss of funds played a role in his death.Īccording to their suit, seen by CBS News, Dan and Dorothy Kearns said Robinhood targets young customers, encourages them to engage in risky trading, and offers no "meaningful customer support" to investors who need help. The family of a 20-year-old who died by suicide after thinking he'd lost $730,000 on Robinhood last year is suing the stock-trading app, accusing it of wrongful death.Īlexander Kearns killed himself on June 12. Visit the Business section of Insider for more stories. They say the app targets young customers and encourages them to engage in risky trading.

Kearns' parents filed a wrongful-death lawsuit against Robinhood on Monday. Alexander Kearns killed himself in June, and his parents say Robinhood is partly to blame. Associated Press LOS ANGELES - The family of a novice stock trader who killed himself after mistakenly believing he lost more than 700,000 are suing Robinhood Financial, claiming the popular.

0 kommentar(er)

0 kommentar(er)